Table of Contents

** Minutes

The importance of EORI numbers for trading outside of the UK and in other European countries

How to apply for a UK EORI number

Apply for an EORI number that starts with XI

What information do I need when applying for an EORI number?

How can SimplyVAT.com and ShipBob can help with international trade?

EORI numbers are something any cross-border online seller needs to get to grips with. But that can be challenging, especially after Brexit. So whether you’re just starting out or looking to expand internationally, an EORI number is essential for businesses trading with the European Union and UK.

In this comprehensive guide, we’ll cover everything you need to know about EORI numbers and whether your business needs one.

What is an EORI number?

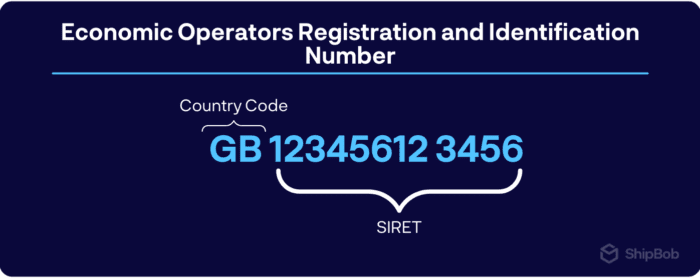

EORI stands for “Economic Operators Registration and Identification.” An EORI number is a unique identification number used to track and register customs information within the EU or UK. It is essential for customs and other authorities to monitor and track shipments coming into and leaving their shores.

Who needs an EORI number?

- An EORI number is necessary for any economic operator with an establishment in the customs territory of the Union or UK.

- Economic operators not established in the customs territory of the Union or UK must also register for customs activities, including customs declarations, Entry Summary Declaration (ENS) and Exit Summary Declarations (EXS), as well as declarations for temporary storage. It is also necessary if they act as a courier.

- Persons other than economic operators must register if it is required by national legislation of the Member State or other legal Union provisions, or if they engage in activities for which an EORI number must be provided.

Have a look on GOV.UK for the latest updates on who needs an EORI number and determine if it applies to you. EORI number registration can be a challenge to navigate, SimplyVAT.com offers expert advice that can assist you with the process.

Format of the EORI number

The EORI number consists of:

- A country code of the issuing Member State (2 letters); followed by

- An identifier that is unique in the Member State (up to 15 alphanumeric characters)

EORI numbers do not expire as they are permanently allocated to economic operators and other persons. However, they can be invalidated upon request or if business activities are ceased. After invalidation, the recorded EORI data is kept for a guard delay of ten years.

The importance of EORI numbers for trading outside of the UK and in other European countries

An EORI number is vital for trading outside of Great Britain and in other European countries. It ensures that customs authorities can identify who is responsible for the goods being imported or exported.

EORI numbers are also crucial for businesses that trade with countries outside the EU, as the number is used to identify the business and the goods being traded. This allows customs authorities to ensure that the proper customs procedures are followed, and that the goods are safe and secure.

When planning your supply chain processes make sure to read this guide on how to best optimise logistics when it comes to your supply chain here.

EORI numbers and Brexit

Before 2020, a UK EORI number could be used for importing goods in the EU. UK EORI numbers are no longer valid when importing into the EU since the UK left, therefore, you will need to register for an EORI number in a EU member state if you are importing into the EU.

This means you might need two EORI numbers. Your EU EORI number would be used for any importations into the EU and your UK EORI number for any imports into the UK.

If you’ve found shipping to EU markets challenging post-Brexit then you’re definitely not alone, check out this blog for 5 things to consider when shipping into the EU.

How to apply for a UK EORI number

For UK businesses, you’ll need to complete the correct paperwork to obtain an EORI number. You will need to apply for an EORI number that starts with GB.

To apply for an EORI number, you will need your:

- Unique Taxpayer Reference (UTR) – find your UTR if you don’t know it.

- Business start date and Standard Industrial Classification (SIC) code – these are in the Companies House register.

- Government Gateway user ID and password.

- VAT number and effective date of registration (if you’re VAT registered) – these are on your VAT registration certificate.

- National Insurance number – if you’re an individual or a sole trader.

If you don’t have a Government Gateway user ID, you’ll be able to create one when you apply. You’ll receive your GB EORI number immediately unless HMRC needs to make any checks on your application. If they do, it can take up to five working days to receive number validation.

Apply for an EORI number that starts with XI

You will also need an XI EORI number if you move goods between Northern Ireland and non-EU countries. Your number will start with XI in this case and you must have applied for a GB EORI number before you can get an XI EORI number.

If you’re not sent one automatically, you can apply online for an EORI number that starts with XI from December 11 2020. You’ll get your number starting with XI within four working days applying that will need to be used on any shipments into Northern Ireland.

To apply, you’ll need:

- Your XI VAT number (if you have one).

- Any VAT numbers issued by an EU country.

- Two documents showing proof of your permanent business establishment in Northern Ireland, such as a bank statement or utility bill.

However, you won’t be asked for proof of permanent business establishment in Northern Ireland if the establishment address is listed on your GB EORI application or your business isn’t based in Northern Ireland but you need an EORI for other reasons.

What information do I need when applying for an EORI number?

The online application process for an EORI number is straightforward, but you will need to have several details available to complete it. You’ll need to give details of the shipment you’re currently intending to clear in or out of the EU. The form can’t be completed ahead of time, and if you skip this information, your application will be rejected.

Here are the details you’ll need:

- The government website lists your business’s start date and Standard Industrial Classification (SIC) code.

- Your Unique Taxpayer Reference (UTR).

- Your Government Gateway user ID and password.

Individuals and sole traders established in the UK should make sure they have a note of their National Insurance number too.

Once you have obtained your EORI number, it is essential to keep it safe and secure. You should provide your EORI number to any parties involved in the shipment of goods, including freight forwarders, customs agents, and couriers. You should also ensure that your EORI number is included on all customs declarations, as failure to do so can result in delays and penalties.

It is worth noting that EORI numbers are not just for businesses involved in large-scale international trade. Any business that imports or exports goods from or to the EU will need an EORI number, regardless of the size or frequency of their shipments.

An EORI number is not required for individuals importing or exporting goods for personal use.

In summary, an EORI number is a unique identifier that is crucial for businesses involved in international trade. It enables customs authorities to identify who is responsible for the goods being imported or exported, and to ensure that the proper customs procedures are followed.

Applying for an EORI number is a straightforward process, and once obtained, it is essential to keep it safe and provide it to all parties involved in the shipment of goods.

How can SimplyVAT.com and ShipBob can help with international trade?

Efficiency and speed are key to running a smooth and successful online store in 2024. By using the dozens of fulfilment centres in ShipBob’s global network, you’ll be close enough to customers across the UK, Europe, USA, Canada, and Australia to deliver an experience they won’t forget.

Pair that with the international VAT expertise of SimplyVAT.com, who can ensure you avoid any issues with compliance at the border, and you’ve got an unstoppable foundation for your ecommerce business.

Learn more about how ShipBob and SimplyVAT.com work together here.

Get started with ShipBob

Interested in using ShipBob’s global fulfilment solution? Connect with our team to learn more.

EORI number FAQs

Below are answers to common questions about EORI numbers.

Is an EORI number the same as a tax number?

No, EORI numbers are not the same as tax or VAT numbers. Although they can often be linked to your VAT number, an EORI number is a unique number used by customs authorities to regulate and report on Importers of Record. Your VAT or tax number identifies your business for tax authorities.

Does an EORI number need to be renewed or updated?

EORI numbers do not expire but can be invalidated upon request. You should also update any information relevant to your EORI application with the relevant authority if there are any changes.

How to make sure my EORI number is valid?

You can check whether your EORI number is valid by using the portals offered by the relevant authority. To check a UK EORI number, the government offers this EORI checker. Similarly, EU EORIs can be checked here.

What are the requirements to obtain an EORI number in the UK?

To apply for a EORI number in the UK, you will need to provide information or documentation such as: Unique Taxpayer Reference (UTR), Business start date and Standard Industrial Classification (SIC) code, Government Gateway user ID and password, VAT number and effective date of registration (if you’re VAT registered), and National Insurance number – if you’re an individual or a sole trader.

How long does it take to receive an EORI number after applying?

A UK EORI number will be given to you immediately unless there are further checks needed on your application. These can take 5 working days or check the government website for updates.

Are there any fees associated with obtaining or maintaining an EORI number?

You can register for an EORI number directly with the customs authorities for free. If you choose to use a service provider to go through the EORI system, there may be an administrative fee for the application.

Can you import goods without an EORI number?

No, you can not import goods for commercial purposes without a valid EORI number.