What is the FIFO Method and How Can it Be Used?

Skip the Scroll — Download the PDF

Download this blog as a PDF to revisit it whenever you want. We’ll email you a copy.

Table of Contents

** Minutes

FIFO formula & calculation example

What’s the difference between FIFO and LIFO?

Which method of inventory management should you use?

When Susan first opened her pet supply store, she quickly discovered her vegan pumpkin dog treats were a huge hit and brought in favorable revenue. But when it was time to replenish inventory, her supplier had already increased their prices.

Though some products are more vulnerable to fluctuating price changes, dealing with inflation when restocking inventory is inevitable.

But no matter what you sell, keeping track of inventory value over time is essential. So how should a brand keep track of fluctuating inventory value over time?

To ensure accurate inventory records, one of the most common inventory valuation methods is FIFO (first-in, first-out), which assumes the oldest inventory items were sold first and the value is calculated accordingly.

Read on for a deeper dive on how FIFO works, how to calculate it, some examples, and additional information on how to choose the right inventory valuation strategy for your business.

What is the FIFO method?

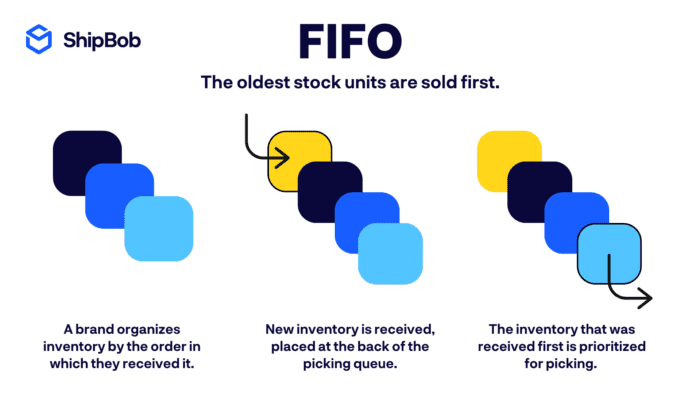

FIFO stands for “first in, first out”, which is an inventory valuation method that assumes that a business always sells the first goods they purchased or produced first. This means that the business’s oldest inventory gets shipped out to customers before newer inventory.

To calculate the value of ending inventory, a brand uses the cost of goods sold (COGS) of the oldest inventory, despite any recent changes in costs.

How the FIFO inventory valuation method works

Since ecommerce inventory is considered an asset and impacts your balance sheet, you are responsible for calculating COGS at the end of the accounting period or fiscal year, your COGS for the year tends to be smaller.

Due to inflation over time, inventory acquired more recently typically costs more than older inventory. With the FIFO method, since the older goods of lower value are sold first, the ending inventory tends to be worth a greater value.

Additionally, any inventory left over at the end of the financial year does not affect cost of goods sold (COGS).

It’s important to note that the FIFO method is designed for inventory accounting purposes. In many cases, the inventory that’s received first isn’t always necessarily sold and fulfilled first.

However, if you sell items that have a short shelf-life, are perishable, or tend to go obsolete quickly, relying on the FIFO method in practice as well as on paper makes it easy to both keep inventory from spoiling and keep your inventory records in order.

Though it’s one of the easiest and most common valuation methods, FIFO can have downsides. For example, FIFO can cause major accounting discrepancies when COGS increases significantly. If accountants use a COGS calculation from months or years back, but the acquisition cost of that inventory has tripled in the time since, profits will take a hit. It also does not offer any tax advantages unless prices are falling.

FIFO formula & calculation example

FIFO is not a metric that one calculates. Rather, it is an approach to calculating crucial balance sheet items like COGS.

Let’s walk through how one calculates this metric using the FIFO method.

FIFO formula

The formula for COGS does not change, whether you use the FIFO accounting method or a different one (such as LIFO). The formula for COGS is:

COGS = Starting Inventory + Purchases − Ending Inventory

Likewise, the formula for ending inventory does not change, no matter which accounting method you are using. The formula for ending inventory is:

Ending Inventory = Starting Inventory + Purchases − COGS

How to calculate FIFO

The key to calculating metrics like COGS and ending inventory under the FIFO method is to assume that you sell all the units of inventory you acquired first before you sell any units of the inventory you acquired later.

For example, say your brand acquired your first 20 units of inventory for $4 apiece, totaling $80. Later on, you purchase another 80 units – but by then, the price per unit has risen to $6, so you pay $480 to acquire the second batch.

At the end of the period, you find you’ve sold 50 of the 100 units in your inventory. Using the FIFO method, you assume you sold all 20 of the original 20 units before you touched the second batch of inventory. This would mean you sold:

- 20 units that cost $4 to acquire (a $80 cost of goods sold)

- 30 units that cost $6 to acquire (a $180 cost of goods sold)

FIFO calculation example walkthrough

Let’s revisit Susan’s pet supply store. Susan started out the accounting period with 80 boxes of vegan pumpkin dog treats, which she had acquired for $3 each. Later, she buys 150 more boxes at a cost of $4 each, since her supplier’s price went up.

Susan now has 230 boxes of dog treats in stock. At the end of her accounting period, she determines that of these 230 boxes, 100 boxes of dog treats have been sold.

Using the FIFO method, Susan assumes that she sold all 80 of the original boxes before dipping into the newer stock. Thus, in her balance sheet, the total cost of goods she sold above (100 boxes) would be:

COGS = Starting Inventory + Purchases − Ending Inventory

COGS = (80 units x $3) + (150 units x $4) − (130 units x $4)

Notice that Susan lists the 130 units remaining in her inventory as costing $4 apiece. This is because she presumes that she sold the 80 units that she bought for $3 apiece first. There are no units of the first, cheaper batch of inventory left.

She finishes her calculation like so:

COGS = $240 + $600 − $520

COGS = $320

FIFO method: Pros vs. Cons

While there is no one “right” inventory valuation method, every method has its own advantages and disadvantages. Here are some of the benefits of using the FIFO method, as well as some of the drawbacks.

Pro: Higher valuation for ending inventory

As mentioned above, inflation usually raises the cost of inventory as time goes on. This means that goods purchased at an earlier time are usually cheaper than those same goods purchased later.

Because FIFO assumes that the lower-valued goods are sold first, your ending inventory is primarily made up of the higher-valued goods. As a result, your ending inventory value is higher.

A higher inventory valuation can improve a brand’s balance sheets and minimise its inventory write-offs, so using FIFO can really benefit a business financially.

Pro: Higher net income

The FIFO valuation method generally enables brands to log higher profits – and subsequently higher net income – because it uses a lower COGS.

Suppose a coffee mug brand buys 100 mugs from their supplier for $5 apiece. A few weeks later, they buy a second batch of 100 mugs, this time for $8 apiece. They sell every mug for $15, and sell 100 units.

Under FIFO, the brand assumes the 100 mugs sold come from the original batch. On each sale, the net profit is $10 ($15 sale price – $5 COGS). Because the brand is using the COGS of $5, rather than $8, they are able to represent higher profits on their balance sheet.

Pro: Often reflects actual inventory movement

For many businesses, FIFO is a convenient inventory valuation method because it reflects the order in which inventory units are actually sold. This is especially true for businesses that sell perishable goods or goods with short shelf lives, as these brands usually try to sell older inventory first to avoid inventory obsoletion and deadstock.

While using FIFO doesn’t mean brands must sell the oldest goods first in reality, it is extremely intuitive for brands that do and helps simplify inventory accounting.

Con: Discrepancies if COGS spikes

FIFO works best when COGS increases slightly and gradually over time. If suppliers or manufacturers suddenly raise the price of raw materials or goods, a business may find significant discrepancies between their recorded vs. actual costs and profits.

For instance, say a candle company buys a batch of 1,000 candles from their supplier at $2 apiece. Several months later, the company buys another batch of 1,000 candles – but this time, the supplier charges $10 for each candle.

This is a significant increase in COGS for the brand. When they use FIFO to calculate ending inventory value, the brand will use the lower COGS – but because that number is outdated and COGS has spiked since then, the company’s recorded profits on the balance sheet will not necessarily match their actual profits (with actual profits being much lower than represented).

Con: Higher taxes

Because net income is usually higher for brands using FIFO, those brands’ income taxes are usually higher as well. For certain businesses, this can cause cash flow issues and eat further into their bottom lines.

What’s the difference between FIFO and LIFO?

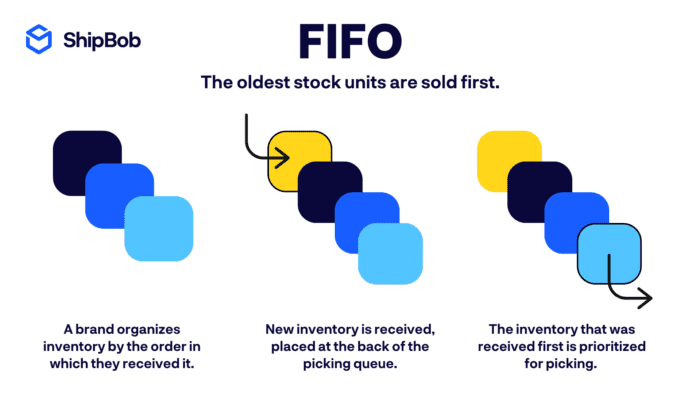

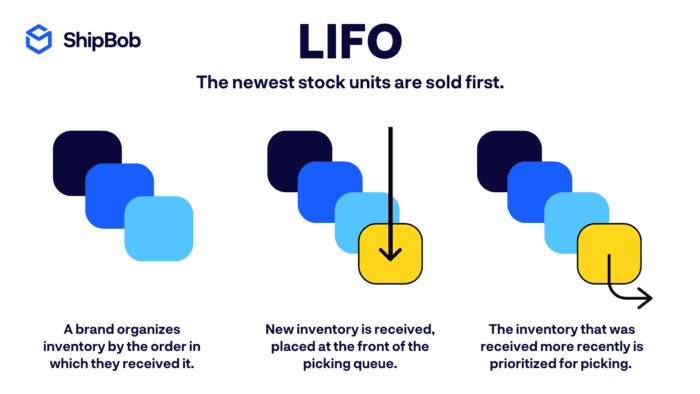

LIFO stands for “last in, first out,” which assumes goods purchased or produced last are sold first (and the inventory that was most recently purchased will be sent to customers before the oldest inventory). It is an alternative valuation method and is only legally used by US-based businesses.

FIFO, on the other hand, is the most common inventory valuation method in most countries, accepted by International Financial Reporting Standards Foundation (IRFS) regulations.

LIFO’s pros and cons are the inverse of FIFO’s. For instance, if a brand’s COGS is higher and profits are lower, businesses will pay less in taxes when using LIFO and are less at risk of accounting discrepancies if COGS spikes. However, brands using LIFO usually see a lower valuation for ending inventory and net income, and may not reflect actual inventory movement.

FIFO vs. Average Cost Inventory

The average cost inventory valuation method uses an average cost for every inventory item when calculating COGS and ending inventory value.

A business would calculate the average cost of every inventory unit (within a certain accounting period) using this formula:

Average Cost of Inventory = (Total cost of all goods purchased) / (total number of inventory units purchased)

The brand then uses that average in their COGS and ending inventory value calculations.

In contrast, FIFO does not use averaging. Rather, every unit of inventory is assigned a value that corresponds to the price at which it was purchased from the supplier or manufacturer at a specific point in time.

While this distinction may seem like a trivial detail, it does impact a business’s COGS, ending inventory value, and how much profit a business books.

For example, say that a trampoline company purchases 100 trampolines from a supplier for $40 apiece, and later purchases a second batch of 150 trampolines for $50 apiece. The company sells every trampoline for $80, and sells 200 of them.

Here is a breakdown of how a business would calculate COGS, ending inventory value, and profit using the average inventory method vs. FIFO:

| Average Cost Inventory | FIFO | |

| Average Cost of Inventory: | = ([100 x $40] + [150 x $50]) / (100 + 150) = ($4,000 + $7,500) / 250 = $11,500 / 250 = $46 | N/A |

| COGS | = (100 x $46) + (100 x $46) = $9,200 | = (100 x $40) + (150 x $50) – (50 x $50) = $9,000 |

| Ending Inventory Value | = 50 x $46 = $2,300 | = (100 x $40) + (150 x $50) – 9,000 = $2,500 |

| Profit | Total sales price – COGS = ($80 x 200) – $9,200 = $16,000 – $9,200 = $6,800 | Total sales price – COGS = ($80 x 200) – $9,000 = $16,000 – $9,000 = $7,000 |

As you can see, the FIFO method of inventory valuation results in slightly lower COGS, higher ending inventory value, and higher profits. This makes the FIFO method ideal for brands looking to represent growth in their financials. The average cost method, on the other hand, is best for brands that don’t see the cost of materials or goods increasing over time, as it is more straightforward to calculate.

FIFO vs. Specific Inventory Tracing

Specific inventory tracing is an inventory valuation method that tracks the value of every individual piece of inventory. This method is usually used by businesses that sell a very small collection of highly unique products, such as art pieces.

Using specific inventory tracing, a business will note and record the value of every item in their inventory. Inventory value is then calculated by adding together the unique prices of every inventory unit.

For example, say a rare antiques dealer purchases a mirror, a chair, a desk, and a vase for $50, $4,000, $375, and $800 respectively. The total inventory value would be $5,225. If the dealer sold the desk and the vase, the COGS would be $1,175 ($375 + $800), and the ending inventory value would be $4,050 ($4,000 + $50).

FIFO is different from specific inventory tracing in that it assumes that one piece of inventory is more or less identical to another – and as long as they were purchased at the same time and for the same price, they are also equally valuable.

Which method of inventory management should you use?

If you sell a product that requires fulfilling older inventory first for quality purposes (especially if you sell perishables and other types of time-sensitive goods), the FIFO method will follow the natural flow of inventory, providing accurate numbers.

For retailers dealing with food items, cosmetics, or electronics, for example, the FIFO method helps to avoid having to write off or write down inventory from the oldest received, in case demand is slower-moving than expected.

Additionally, it ensures that you are more likely to use the actual price you paid for the goods in your income statements, making the calculations more accurate and simple, and record-keeping much easier.

FIFO is also the option you want to choose if you wish to avoid having your books placed under scrutiny by the IRS (tax authorities), or if you are running a business outside of the US.

Leave inventory management to the pros (ShipBob)

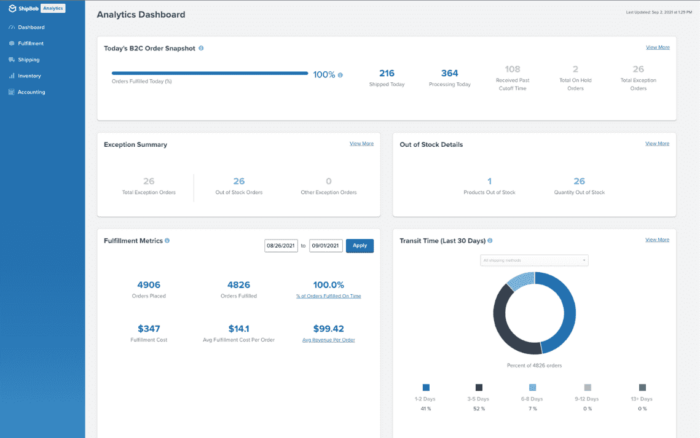

ShipBob’s ecommerce fulfilment solutions are designed to make inventory management easier for fast-growing DTC and B2B brands.

For inventory tracking purposes and accurate fulfilment, ShipBob uses a lot tracking system that includes a lot feature, allowing you to separate items based on their lot numbers.

When you send us a lot item, it will not be sold with other non-lot items, or other lots of the same SKU.

Following the FIFO logic, ShipBob is able to identify shelves that contain items with an expiration date first and always ship the nearest expiring lot date first.

If you have items stored in different bins — one with no lot date and one with a lot date — we will always ship the one updated with a lot date first.

Our premium fulfilment software’s built-in inventory management tools also help you to:

- Keep track of inventory in real time.

- Easily update and manage SKUs.

- View sales trends to forecast demand.

- And much more.

With this level of visibility, you can optimise inventory levels to keep carrying costs at a minimum while avoiding stockouts.

ShipBob finally gave us the visibility and analytics we were looking for. Through the software, we get real-time insight into how much inventory to allocate to a specific warehouse, our current on-hand inventory levels, and how long each SKU is going to last by location. ShipBob provides a lot of distribution metrics, and everything presented is useful.

Mithu Kina, Founder and CEO of Baby Doppler

Interested to see our fulfilment solution in action? Check out a 3D behind the scenes look at how ShipBob operates:

Whether you’re a business owner or an ecommerce operations manager, ShipBob can help you expand your distribution logistics network and manage the flow of goods throughout your entire ecommerce supply chain without being involved in the day-to-day logistics operations.

To grow your brand with ShipBob, get started by requesting pricing.

Unlock Turbo Warehouse Management with ShipBob’s WMS

For brands looking to store inventory and fulfil orders within their own warehouses, ShipBob’s warehouse management system (WMS) can provide better visibility and organisation.

Ecommerce merchants can now leverage ShipBob’s WMS (the same one that powers ShipBob’s global fulfilment network) to streamline in-house inventory management and fulfilment.

With real-time, location-specific inventory visibility, intelligent cycle counts, and built-in checks and balances, your team can improve inventory accuracy without sacrificing operational efficiency.

For brands looking to scale internationally, ShipBob even offers a hybrid solution where merchants can employ ShipBob’s WMS technology in their own warehouses while simultaneously leveraging ShipBob’s fulfilment services in any of ShipBob’s fulfilment centres across the US, Canada, Europe, and Australia to improve cross-border shipping, reduce costs, and speed up deliveries.

FIFO FAQs

Here are answers to the most common questions about the FIFO inventory method.

Does ShipBob offer FIFO for their customers?

Yes, ShipBob’s lot tracking system is designed to always ship lot items with the closest expiration date and separate out items of the same SKU with a different lot number. ShipBob is able to identify inventory locations that contain items with an expiry date first and always ship the nearest expiring lot date first. If you have items that do not have a lot date and some that do, we will ship those with a lot date first. Learn more about our lot tracking system here.

Is FIFO better than LIFO?

Though both methods are legal in the US, it’s recommended you consult with a CPA, though most businesses choose FIFO for inventory valuation and accounting purposes. It offers more accurate calculations and it’s much easier to manage than LIFO. FIFO also often results in more profit, which makes your ecommerce business more lucrative to investors.

What is the difference between FIFO and moving average costing methods in valuing raw materials inventory?

Using the FIFO method, the cost of goods sold (COGS) of the oldest inventory is used to determine the value of ending inventory, despite any recent changes in costs.

Under the moving average method, COGS and ending inventory value are calculated using the average inventory value per unit, taking all unit amounts and their prices into account.

For example, say a business bought 100 units of inventory for $5 apiece, and later on bought 70 more units at $12 apiece. The business sold 150 units to customers.

Using FIFO, the COGS would be $1,100 ($5 per unit for the original 100 units, plus 50 additional units bought for $12) and ending inventory value would be $240 (20 units x $24).

Under the moving average method, the average inventory value per unit as of the merchant’s most recent inventory purchase would be ([100 x $5] + [70 x $12]) / 170 = $7.80. Using that average, COGS would be $1,170 (150 units x $7.80), and ending inventory value would be $156 (20 units x $7.80).

Why is the FIFO method popular?

The FIFO method is popular with ecommerce businesses because it provides a higher valuation for ending inventory, higher net income, often reflects actual inventory movement, and is well-suited for brands selling perishable products.

How does the FIFO method affect financial statements?

The FIFO method impacts how a brand calculates their COGS and ending inventory value, both of which are always included on a brand’s balance sheet at the end of a financial accounting period.