Inventory Revaluation Guide

The ecommerce landscape is full of change. Whether it’s supply chain disruptions, fluctuations in demand, or even just shifts in the exchange rate, it can feel like no two days are the same.

This can be exciting – but it can also make inventory valuation and bookkeeping tricky. What do you do when a sudden spike in demand causes the value of your inventory to skyrocket? What if a supply chain disruption renders huge swaths of your inventory unsellable?

Conducting regular inventory revaluation helps you stay on top of these what-ifs. By closely tracking inventory value over time, you can not only improve inventory accuracy and eliminate risks of financial surprises or taxation issues, but you can also make business decision-making easier for yourself.

In this article, we’ll dive deep into what inventory revaluation is, how it works, its benefits, and how your brand can use inventory valuation best practices to better manage your balance sheet.

So, what do you want to learn?

What is inventory revaluation?

Why is inventory revaluation crucial?

How inventory revaluation looks on your balance sheet

Inventory revaluation best practices & tips

Request Fulfillment Pricing

Let’s talk. Our experts can help you boost your order volume by 30% year over year.

A fulfillment expert will get back to you shortly. Privacy Policy

What is inventory revaluation?

Inventory revaluation is the process of updating your recorded inventory costs to reflect changes in your inventory’s value. These changes could be the result of:

- Abnormal spoilage

- Exchange rate fluctuations

- Disrupted supply chains

- Inventory obsolescence

- Damage to inventory

Whatever the cause, changes in your inventory’s recorded cost can hugely impact your business’s balance sheet. This means that it is very important to consistently revalue your inventory, so that your financial reporting and taxes are accurate and above-board.

How does inventory revaluation work?

The goal of the inventory revaluation process is to reassess the value of your inventory. But what constitutes “value”?

Standard Cost Revaluation

Some businesses may define an inventory unit’s “value” as the amount of money that they paid to acquire that unit – in other words, the original unit cost of inventory. This may be the amount of money spent on the raw materials that went into creating the finished goods, or the amount of money the brand paid to purchase the unit from a wholesaler.

On a business’s income statement, this value is usually expressed as COGS, or “Cost of Goods Sold. The formula to calculate COGS is:

COGS = Beginning inventory + Purchases – Ending inventory

Based on this equation, if you wish to calculate the value of ending inventory, it would be:

Ending Inventory = Beginning inventory + Purchases – COGS

Replacement Cost Revaluation

Other businesses may define a unit’s value as the amount of money they could earn if they sold that unit at its current market price.

That amount is called your inventory’s net realizable value, or NRV. The formula for NRV is:

NRV = Market value of the product – Product manufacturing and miscellaneous costs

A positive NPV indicates a profit, while a negative NRV indicates a loss. For example, say a brand spends $100,000 to acquire 100 candles, and the current market value of each candle spikes from $1 to $5 apiece. The brand would calculate a positive NRV like so:

NRV = ($5 x 100,000 units) – $100,000

NRV = $500,000 – $100,000

NRV = $400,000

Calculating NRV helps prevent you from accidentally overstating your inventory’s value on your balance sheet. After all, if you paid $100,000 for your inventory, but could only earn $20,000 from selling it right now, listing your inventory’s value as $100,000 could be misleading.

Between these two approaches to inventory revaluations, brands will typically use the approach that gives them the highest inventory value.

Why is inventory revaluation crucial?

Inventory revaluation can be tricky, so you may wonder if it’s worth the trouble. Here are just a few of the reasons why it’s not only important, but necessary for brands to revalue their inventory – and how it can help you.

Achieve financial accuracy & build a better business strategy

You can only make good business decisions (like where to invest your capital or when to repurchase inventory) if you understand the state of your finances.

By conducting an inventory revaluation, you can make sure you – and any investors – have an accurate picture of your brand’s financials. This enables you to be truthful, responsible, and more strategic as you build your brand.

Fulfill tax obligations

Because you will be taxed on your company’s assets, it’s absolutely critical to know the value of those assets. If your inventory value changes due to loss, damage, or spoilage, you are also required to note that change in value on your taxes as well – so tracking inventory value of time can save you a lot of work and stress.

Navigate supply chain breakdowns

Your inventory’s value may shoot up in the case of supply chain disruptions. You need to adjust the value of your inventory accordingly (adding the extra costs to the original price) so that you do not sell it at a loss.

For example, say you rely on distributors in China. If your primary distributor is not able to send your inventory due to port shutdowns or trade sanctions, you will need to source inventory from another distributor in Germany. In that case, you will need to factor the cost of air freight into your inventory’s value to ensure that your financial records stay accurate.

Account for product damage or obsolescence

When you order, transport, and store inventory, some of it is bound to get damaged or obsolete over time. Since these SKUs cannot be sold, you will have to note the cost of these goods and deduct them from any profits in your inventory accounting.

For example, if you are selling cookie dough (with a shelf life of 6 months), there are chances that a few units are unsold even after the half-year mark. So, you need to revalue the remaining inventory revaluation to adjust for the losses.

Keep up with demand fluctuations

You may stock a lot of inventory only to face a sudden drop in demand. This would result in high carrying costs and tied-up capital, which can drive many retailers to bankruptcy.

To keep your inventory lean, you’ll need to track demand forecasts and constantly carry out inventory revaluation. This will help you with inventory control, and help you handle the peaks and dips of ecommerce demand.

Here’s how inventory revaluation looks on your balance sheet

When you carry out an inventory revaluation, it’s going to affect your balance sheet and finances.

Say, for example, that you conduct an inventory audit to find that some of your inventory was destroyed in a recent flood you experienced in your warehouse. When you adjust the value of your inventory accordingly, you’ll perform what’s known as a write-off, where you note on your balance sheet that that portion of inventory has lost all of its value.

In another instance, you may find that some inventory is still sellable, but as trends have evolved, the market price has fallen steeply. In this case, you’ll need to perform an inventory write down, where you list it as an expense (depreciation) on your balance sheet to reduce tax liability.

Whether a revaluation’s effect on your balance sheet is positive or negative, it’s incredibly important that you record it carefully and accurately. Accounting errors can lead to inventory shrinkage (where inventory reports do not match sales records), which can in turn cause tax issues and even result in the IRS potentially auditing your business.

To avoid this, make sure that your inventory revaluation efforts are always reflected properly in the right financial statements. If necessary, consult a professional to help you.

Revalue your inventory with these best practices & tips

Inventory revaluation can stump even veteran ecommerce sellers – but that doesn’t mean it’s impossible. Here are some best practices, tips, and tricks to help you get started.

1. Determine why you’re revaluing your inventory

It’s important to determine the purpose of an inventory revaluation before diving in, as the purpose may influence what revaluation method you choose or what processes you employ. For instance, you may perform an inventory valuation differently if it’s to clean up your finances than you would if the goal were to reduce tax implications.

2. Decide on the revaluation scope.

Once you determine the purpose of the revaluation, you’ll need to establish the scope of the revaluation. This includes deciding:

- Which inventory items that must be included

- The frequency of revaluation

- The degree of detail required

3. Choose the right revaluation method

Typically, companies pick from a few top inventory valuation methods that deliver higher inventory value.

Some brands use the FIFO (or “First-In, First-Out”) method. This method assumes that items purchased first are sold first, meaning that your COGS is based on the cost of the first inventory you acquired (rather than those you acquired most recently).

The FIFO method is a great choice for brands that want their COGS to reflect their production schedule, and that are looking to increase net income on their financial statements. However, it often incurs greater tax liabilities than other methods.

Other brands choose the replacement cost method, where inventory is revalued based on its current market price, rather than the original purchase price. This way, you can compare the historical price of each unit stock with NRV to deduce the losses, if any.

The revaluation method that you select should serve the interests of your brand, and help you achieve the goals you set at the beginning of the revaluation process.

4. Maintain a healthy reserve of inventory

In case of losses due to broken, stolen, expired, or obsolete stock, you need to maintain reserve stock in your warehouse. Your inventory reserve also needs to be thoughtfully planned, or you could end up tying up capital and investing in too much excess stock that can become obsolete. Alternatively, if the inventory reserve is too small, you could experience stockouts.

5. Leverage an inventory management system

Inventory revaluation isn’t a one-and-done deal. Inventory can lose or gain value all throughout its lifecycle, and it can be very challenging to keep track of these constant fluctuations in inventory cost, as well as dozens of inventory transactions.

To make the inventory revaluation process easier, many brands use an inventory management system, or IMS. With the right inventory system in place, a brand can perpetually track inventory as it moves throughout the supply chain and access real-time inventory data at any point. Some systems also automatically track and record key inventory metrics, making it easy to investigate or even avoid discrepancies in inventory levels or value over time.

ShipBob’s inventory management solution prioritizes growth

ShipBob’s solutions are designed to simplify ecommerce brands’ logistics and fulfillment operations – and that includes inventory revaluation.

Our software features built-in inventory management capabilities that help you understand your inventory’s value, track inventory over time, and optimize inventory levels to better meet customer demand. Read on to discover how ShipBob’s technology can help your brand scale its inventory management and grow efficiently.

Sort and distribute inventory across warehouses

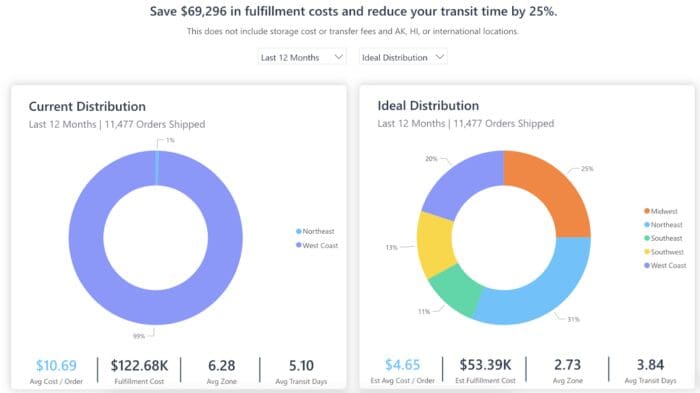

When your inventory is intelligently allocated according to customer demand, you’re at far less risk of inventory spoilage and obsoletion. ShipBob enables merchants to distribute their inventory across dozens of local and international warehouse locations, so that the right stock units are stored close to the customers that want them. You can even use our Ideal Inventory Distribution tool to calculate the most strategic distribution between fulfillment centers to optimize for delivery speed and cost.

Through ShipBob’s Inventory Placement Program, ShipBob’s team will even take care o f physically distributing your products for you. All you have to do is send your inventory to a hub location, and ShipBob will take care of the rest.

Enjoy real-time inventory status updates

ShipBob offers full inventory visibility from a single dashboard, no matter where your inventory is located. Through your ShipBob dashboard, you’ll be able to view real-time inventory analytics and track inventory at the SKU level, so that you stay in the loop at all times.

Automate reorder points

It’s easy to forget to reorder inventory until it’s too late – but with ShipBob, merchants can arrange to receive automated reorder notifications when inventory levels dip below a predetermined threshold. This enables you to prevent stockouts and helps you keep inventory levels balanced.

Watch as your orders are fulfilled

ShipBob offers a transparent view of orders as they are picked, packed, and shipped, as well as status updates for the goods in transit. We also support end-to-end order management with local and global shipping.

Prevent stockouts

When you do not account for sufficient reserve stock, it can result in stockout costs, lost revenue, and disappointed customers. ShipBob helps you mitigate stockouts by providing demand forecasting tools that help you calculate ideal inventory levels and reorder points, and stick to them.

For more information on how ShipBob can help your brand manage its inventory, click the button below to speak to an expert.

Inventory revaluation FAQs

Below are answers to common questions about inventory revelation.

How often should I revalue my inventory?

Revaluing inventory is a non-stop endeavor. Any market fluctuations, supply chain disruptions, or storage and transport mishaps can cause the value of the inventory to fluctuate. As a result, many brands choose to partner with an ecommerce enablement platform like ShipBob that makes it easier to track inventory perpetually and over time.

What’s the impact of inventory revaluation on taxes?

The inventory revaluation can have a big impact on reported revenue across fiscal years. This will, in turn, have a big impact on the amount of income tax you pay each year.

How can ShipBob aid in the inventory revaluation process?

ShipBob helps brands track key inventory metrics in real-time that can help you calculate COGS, NRV, and shrinkage rate. ShipBob’s software also perpetually tracks inventory as it moves throughout the supply chain, so that you can investigate or even avoid discrepancies in inventory levels or value over time.