Table of Contents

** Minutes

Connect with early adopters to tap into their innate desires

Nail your segment and scale effectively to coexist with Amazon

This is part one in our interview series to demystify the secret to ecommerce and DNVB success.

Web Smith, Founder of 2PM

In a world where Amazon is “the everything shop” and many consumers begin their search for a product there, direct-to-consumer brands face many challenges when it comes to standing out and competing.

So, what are the successful DNVBs doing to build brand equity?

We sat down with the Founder of 2PM, Web Smith, who also co-founded Mizzen+Main, was the Director of eCommerce at Gear Patrol, and ran marketing at brands such as Rogue Fitness.

We discussed, among other things:

- How to cultivate a brand that really connects with customers

- How DNVBs coexist with Amazon

- The keys to an amazing customer experience

Connect with early adopters to tap into their innate desires

Most companies hope to reach a certain level of brand awareness and adoption among their audience. A great indication of that is seeing consumers who incorporate a product or brand into their lifestyle.

Take Away, the luggage brand you see everywhere now.

Web owns Away products and experiences a couple common moments of impact when travelling:

- Walking through an airport with Away luggage in hand and you see somebody else doing the same — there’s this smile and nod moment among complete strangers.

- Entering a plane and the gate agent asks if your battery is out — just by looking at the bag or carry on itself. They’re so used to seeing Away luggage that they know there’s a detachable battery that comes out of it.

These interactions reinforce that Away has gained a significant level of penetration and brand awareness in those environments. This success comes without ever selling Away products on Amazon. In fact, they attribute that to their $1 billion+ valuation, with the belief that you choose a brand because you love the brand or product — not because it’s just a commodity you can purchase on Amazon.

While a piece of Away luggage is not an overly expensive product (as compared to a Louis Vuitton luggage that you might see once or twice when travelling depending on the city that you’re in), Web’s noticed there is an affinity that skews towards the affluent.

“I was sitting toward the front of a plane on a recent flight, and within five to six rows in either direction, I saw 12 different colours of Away luggage. On another trip, I saw a family of four that was dressed to the nines, and all four of them had Away luggage. The two children had the kids versions, and the parents had Louis Vuitton duffles on top of their Away bags,” he added.

The cost of each of their Away suitcases were in the $200 – $300 price range, but everything else they were wearing had to be worth at least $500 a piece.

“When Away comes out with something that’s more expensive, let’s say a $1,500 version of their aluminum luggage, it will be interesting to see what percentage of their existing consumer base will adopt it. I venture to guess it’s a significant amount.”

Web Smith, Founder of 2PM

Web pointed out that Away’s not the only brand experiencing this socioeconomic phenomenon: “If you are in certain circles around Sand Hill or at Menlo Park, you’re going to see quite a few pairs of Allbirds. But there is not one person wearing those $100 pair of shoes that is worth less than $10 million.”

Not to get too psychological, but there seems to be some type of signaling that goes beyond the monetary value. So, what is in a brand’s DNA that has wealthy people purchasing their moderately-priced products?

Web has a hunch: “I think that a lot of the people who are drawn to these products are typically independent thinkers. They like to associate themselves with innovation or exploration. So in a way, part of the appeal is that they were first. And I think that they expect the product will go up market sooner than later.”

With this logic, the traditional customer will buy the $300 hard shell Away carry on, and then they’ll upgrade to the aluminum one over the next year or two. Then what’s next?

According to Web, these consumers expect something that will eventually meet the qualifications or the classifications of luxury. And he thinks that we’re going to see that across the board.

But if products that were $100 will eventually become $300, and products that are $400 will eventually become $900, will the market respond?

“Atoms is already anticipating that,” Web explained. “They have their $180 pair of shoes but they’re already testing custom leather versions with Alexis Ohanian that will eventually debut on the market for significantly more than $180.”

Get customers in. Appeal to the early adopter ethos at first. Then scale with them. He may be onto something.

Nail your segment and scale effectively to coexist with Amazon

Amazon makes up 5.1% of all retail in America, which means 94.9% is still available to compete. And though they make up 47% of online retail in the US, Web knows the companies that have achieved the greatest exits over the last 10 years have been marketplaces that compete with Amazon in some way, shape, or form.

Whether that’s Chewy, The RealReal, Stitch Fix, or even Rent the Runway, these companies have found ways to take portions of Amazon’s consumer base and optimise to meet their needs.

Web explained it gets a little bit tougher for DNVBs though: “You’re dealing with a few market forces that marketplaces don’t have to deal with. Can Amazon knock you off? Do you have IP to protect yourself? Is your brand deep and strong enough to outlast Amazon’s emergence into your category?”

“You know that you’ve made it as a direct-to-consumer brand when Amazon launches something completely similar to your product and it doesn’t affect your bottom line.”

Web Smith, Founder of 2PM

And Web knows this firsthand. As the former cofounding CMO of Mizzen+Main, there was a time when none of their products were sold on Amazon.com. At this time, there were several substitutes to consider; However, it didn’t affect the company very much at all.

What it did tell them was maybe they should also start selling on Amazon. And Amazon became a worthwhile channel for the company.

“When you look at how the actual product competed against Amazon’s native brands as well as other smaller, lesser known companies, it was an example of how the company with the most brand equity — regardless of the price — tends to perform better,” Web said.

Amazon’s assumption is that if you make a product that’s similar enough and you make it cheaper, then people will peel off from the incumbent direct-to-consumer brand. And naturally, a very small percentage of those people will do that.

“I think that consumers are less focused on promotional pricing or value pricing than people tend to believe,” Web said “They like the one-on-one connections with the founders and the C suites of those companies.”

Not only do consumers want brands that they can have a deep connection with, but they also want to be understood.

Web recalled a recent dinner with several executives at some of the biggest mall brands in the country that had achieved such a scale that they don’t know exactly who their consumers are anymore.

“A lot of these incumbent brands are building products for a huge audience that they don’t quite understand. New brands can focus on one specific customer, drill down on that customer, and build one-on-one relationships in ways that major companies can’t.”

Web Smith, Founder of 2PM

There are plenty of examples of this, Web noted: “Whether it’s Andie or Summersalt for swimwear, Third Love or Adore Me for lingerie, or Rhone for athletic wear, these brands are segmenting away the existing retail structure.”

Provide the customer experience to match expectations

In addition to knowing who their customers are, up-and-coming DNVBs must understand how logistics plays into their success.

“I think shipping is the most important part of the direct-to-consumer process. Brands tend to frontload on design, brand messaging, and other pretty things that help you grow attached to a company in the first place, but then they fail to deliver on the back end.”

Web Smith, Founder of 2PM

He added, “You want to know where your product is at all times so you know when it’s going to arrive to your house and you can account for that despite your crazy schedule. I think it’s really important to consider how much the typical consumer has going on and what they’re juggling.”

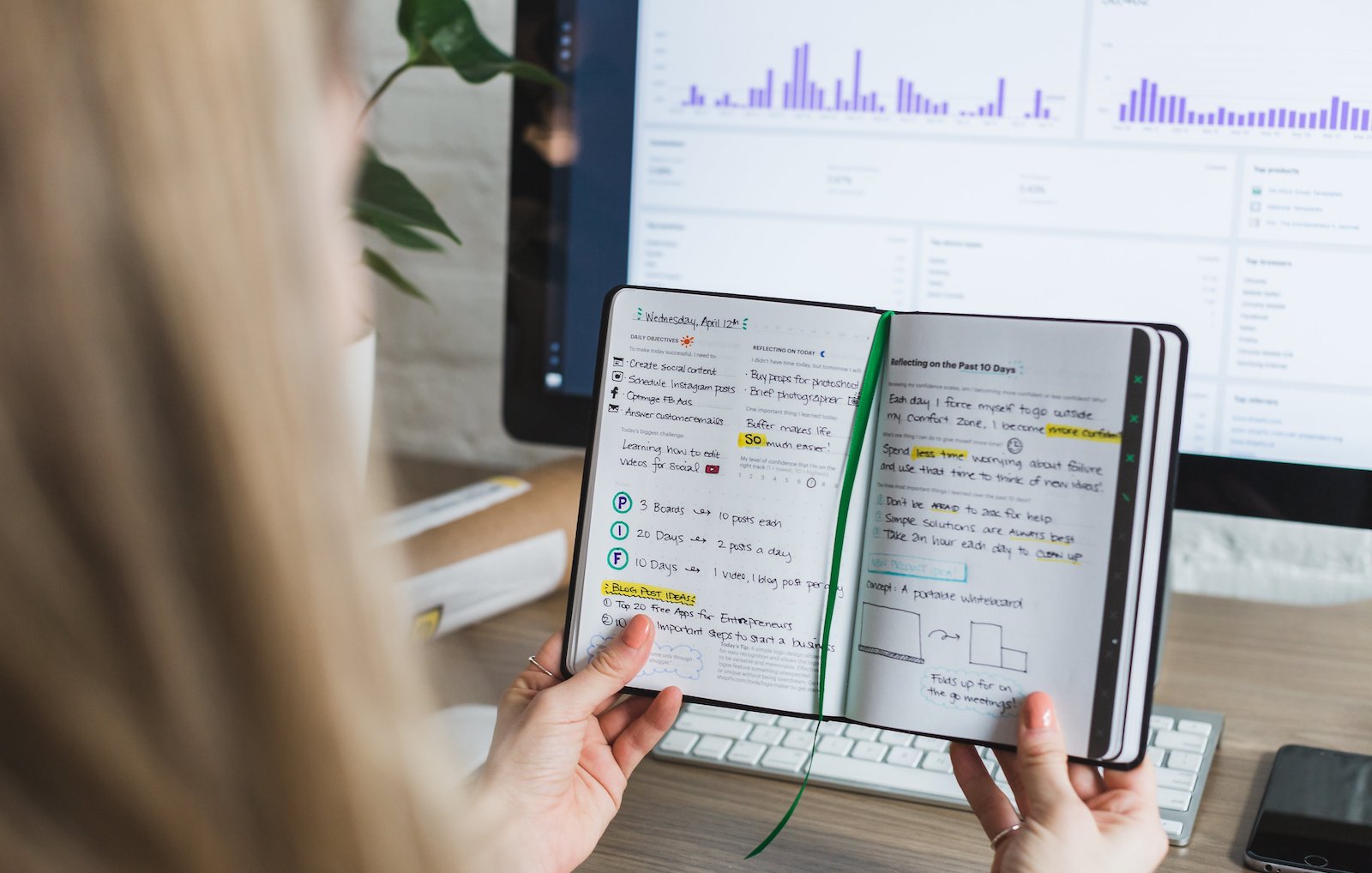

Web believes orders should be shipped within 24 hours. He was one of the very first customers of ShipBob client Doris Sleep, and posted about his post-checkout experience in his newsletter.

Like many consumers, Web prefers to have the products he ordered delivered realistically within two to five days — if not faster — and wants some accountability.

“When a product arrives at your door within three to four days the first time you buy from that brand, you’re more likely to buy that product more often and you’re also more likely to tell your friends to buy that product more often,” he said.

It’s a form of customer acquisition and it should be invested in as such. For brands unable to execute this on their own, they can turn to third-party logistics (3PL) providers.

“When outsourcing fulfilment, some brands typically find the cheapest route to go when they consider 3PLs without understanding that process could also be a customer acquisition form in some ways. Brands are only shooting themselves in the foot by not investing heavily in partnerships like ShipBob.”

Web Smith, Founder of 2PM

If your brand can provide the delivery experience to match both the expectations set by Amazon and the connection that they have with your brand, you will drive more lifelong customers.

Learn more: Offer best-in-class shipping

If you want your brand to provide the shipping experience today expected by consumers, then check out ShipBob. ShipBob provides the fulfilment services, technology, and scalability needed to thrive today and tomorrow. Request pricing below.

Want more insight into DTC success? Read the rest of the series here: