Table of Contents

** Minutes

What is an ecommerce pricing strategy?

Create a pricing strategy that’s right for your business and customers

The 8 pricing strategies for ecommerce

Combining ecommerce pricing strategies when needed

An effective pricing strategy can make or break your ecommerce business. Do you set prices low to stay competitive but reduce profits? Or, do you set higher prices but risk missing out on as many new customers?

Using the right pricing strategy for your ecommerce business can help scale your business and grow your revenue and profits. Although product pricing is a difficult task, there are ways to identify the right pricing strategy that fits your business.

In this article, we’ll go over why you need an ecommerce pricing strategy and the eight most common pricing strategies used by ecommerce brands.

What is an ecommerce pricing strategy?

An ecommerce pricing strategy is a well thought-out plan that helps determine how you accurately price products to increase sales and profits while staying competitive. Different ecommerce pricing strategies are used depending on the type of products sold, product demand, and competition.

The importance of having a defined pricing strategy

The right ecommerce pricing strategy is different for each business. And even as a business grows, it might need to adjust its strategy. For example, a simple cost-plus pricing strategy focuses on generating profit from each sale. Cost-plus works for the early stages of an ecommerce business, but might not be sustainable long-term.

As your business grows, costs might grow exponentially, and the true cost per order and/or acquisition cost can rise as well. You need an ecommerce pricing strategy that will help you scale your business. There are many different types of pricing strategies used by ecommerce businesses that don’t harm profits in the long run.

Even if your ecommerce business is currently profitable, there could be opportunities to improve profits further if you continue to reevaluate your pricing strategy and improve upon it.

Create a pricing strategy that’s right for your business and customers

Many times, an ecommerce pricing strategy is based on the target audience, what your ideal customers are willing to pay, and where they currently shop for similar products. The right pricing model will come down to what shoppers are willing to pay for your product based on several factors, such as brand reputation, demand, and competition.

Who is your customer?

Developing buyer personas can help you better understand your potential customers. By knowing the demographics, traits, disposable income, and buying habits of your target audience, you can create a pricing strategy that fits your business.

For instance, some customers are more cost-consciousness while other customers are willing to a premium price for certain products. Be sure to do your research and not implement an ecommerce pricing strategy based on a guess.

What makes your business shine?

To truly differentiate among thousands of ecommerce brands, your business needs a way to stand out, and the right pricing strategy can help.

For example, international retailer H&M offers stylish, sustainable, and high-quality clothing at an affordable price. Their pricing strategy has helped them become a renowned brand because they were able to fill a gap in the clothing market.

The 8 pricing strategies for ecommerce

Picking the right ecommerce pricing strategy is going to require trial and error, as well as reevaluation over time. While a simple cost-plus pricing strategy might help with initial growth, it could hamper your business in the long run as costs begin to rise.

Choosing the right pricing strategy depends on several factors, from how much it costs to produce your product to customer demand. Here are eight different pricing strategies used by growing ecommerce brands.

1. Cost-plus pricing

The cost-plus pricing strategy (also known as ‘markup pricing,’ ‘breakeven pricing,’ or ‘cost-based pricing’) generates profits by adding a fixed percentage margin to the cost of a product.

Cost-plus is one of the most basic and straightforward pricing strategies for new and/or smaller ecommerce businesses because the formula is simple and easy to calculate.

Let’s say you sell shoes online. To use cost-plus pricing, you’d first gather the costs of materials, labour, and fixed costs per product and add them up:

- Materials: $10

- Labor: $15

- Fixed costs: $20

- Total cost: $45

To make a profit, the shoes have to sell for at least $45.01. However, we know that charging $0.01 more than the product’s total cost isn’t viable since you also have to account for customer acquisition costs, shipping costs, taxes, ecommerce returns, and other expenses.

Most ecommerce businesses achieve a profit margin between 50-100%. If your goal is a 50% profit margin, you have to charge $90 for one pair of shoes. You’ll then make a profit on the sale while accounting for the true cost per order.

Cost-plus pricing pros

Cost-plus is a popular pricing strategy because it’s easy as long as your prices are higher than the true cost per order. Your finance team or accountant can quickly help you set up a cost-plus tracking system to check how your business is performing.

Cost-plus pricing cons

It’s possible to mess up the calculations when using cost-plus pricing. If done incorrectly, your business can lose money on each sale. If costs of materials unexpectedly increase, but product prices stay the same, you’ll lose out on profits. You could increase your prices, but that could derail current customers from shopping at your store again.

2. Competition-based pricing

Most often used for commodities, competition-based pricing is based on offering better prices than your competitors. This means comparing your prices to the price of similar products offered by your competitors across channels and making pricing adjustments accordingly.

For example, if you run a streetwear brand that targets Gen Z college students, you might need to use a competition-based pricing strategy to compete with other streetwear brands targeting Gen Z. Spending time and effort to research your customers can yield dividends for your business.

Competition-based pricing pros

Competition-based pricing can help you beat the competition by luring in their customers with cheaper prices. If you’re looking to attract cost-conscious customers, this is a good option for you as they are willing to give up brand loyalty to save money.

There are also pricing apps available, like Price Intelligently and Prisync, that make it easy to do market research and set prices based on competition.

You can also factor in how much you and your competitors charge for shipping, as offering free shipping can be another cost differentiator over similar brands.

Competition-based pricing cons

Unlike brick-and-mortar stores, customers can easily visit other ecommerce shops in a few seconds if they don’t like your prices. If you can’t continue to lower your costs to make cost-conscious customers happy, you’ll start to lose sales.

Competitive pricing can lead to a ‘race to the bottom.’ If a competitor chooses to compete with you on price, both brands will continue to cut prices, which can ultimately make your product seem less valuable and desirable.

3. Value-based pricing

Value-based pricing focuses on figuring out the maximum amount a customer is willing to pay for your product. Value-based customers focus more on quality and ‘fairness’ over anything else. Customers like this need to know that the product you’re selling is of the best quality, fairly sourced, eco-friendly, and/or hard to come by.

For instance, if selling jewelleryonline, costume jewellerywould be priced on the lower side because the customer is aware it’s made with low-cost materials. Higher-end jewelry, like an engagement ring from Tiffany & Co., would sell at a higher price because people are willing to pay more for premium materials like diamonds.

Value-based pricing pros

Value-based pricing can be applied to all types of products because of the perceived product value. Value pricing also helps you understand how valuable your products are. If you find customers are willing to pay more than you currently charge, you could introduce a new line of products at a higher cost.

Value-based pricing cons

Value-based pricing can be tough to get right. You have to spend time on studies and focus groups to find the best price point that keeps customers happy without causing a decline in sales. Also, the perceived value of a product can change over time.

4. Price skimming

Price skimming is a strategy where a product’s initial price decreases over time. Price skimming is popular for tech products that become less valuable or obsolete as new technology is introduced (e.g., VCRs and digital cameras were once in high demand, but as DVDs and smart phones with high quality cameras were introduced to the market, the old tech became less desirable). As newer product models become available, older models become cheaper to purchase.

Technology products like smartphones, televisions, computers, and game consoles have a segment of customers known as ‘early adopters.’ These types of customers are willing to pay a higher price for the latest and greatest.

Another example is seasonal products, like holiday decor or winter/summer sports gear, which usually goes on sale or clearance during off-seasons.

Price skimming pros

Price skimming is a good strategy for brands that offer high-demand products, technology, or seasonal items. As time goes on, customers will most likely want newer products, but you can still benefit from putting last year’s products on sale to attract budget shoppers.

Price skimming cons

Price skimming is not a good option for newer and smaller ecommerce brands. Apple can price skim because iPhones are in high demand, they consistently put out newer models with better features, and the brand has some of the most loyal customers. Price skimming works only if you have loyal customers and can attract ‘early adopters.’

Price skimming doesn’t work for businesses that sell everyday products or commodities. If your company sells cosmetics, price skimming might not be the best strategy as makeup has a short shelf life and is a highly saturated market.

5. Loss-leader pricing

Loss-leader pricing focuses on selling products at a loss to entice customers to purchase a more expensive product offering. The cost of the loss is made up when customers purchases additional items that are needed to make the sold product functional (e.g., a printer and printer ink, a video console and video game, etc.). The extra products can be purchased at the time of the initial sale or later on.

An example of a product that uses loss-leader pricing is razor blades. Most razors are sold inexpensively along with a couple of sample blades. But when it comes time to buy new blades, the customer might notice that the blades come with a premium price. Since they already bought the razor, they most likely will pay for extra blades.

Loss-leader pricing can be used to increase the average order value by having consumers want to purchase the complementary product in addition to the very cheaply-priced product, where they might be willing to add more to their cart because they already feel like they’re getting a deal.

Loss-leader pricing pros

Loss-leader pricing is a great way to entice customers to make an initial purchase, and have them come back to purchase additional products from your online store, increasing their customer lifetime value (LTV). You can use this as an opportunity to create product bundles or sell product accessories to make up for the loss of selling the initial product.

Loss-leader pricing cons

Loss-leader pricing doesn’t work if customers don’t make additional purchases or if the ecommerce shipping cost is as high as the cart value. The ecommerce pricing strategy relies on customer loyalty to the product and/or brand.

With loss-leader pricing, you will need to make sure customers have an excellent shopping experience, so they’re willing to buy from you again.

6. Dynamic pricing

Dynamic pricing is all about flexibility; prices are never set in stone and can increase or decrease at any moment due to constant changes in demand.

Dynamic pricing is sometimes referred to as ‘surge pricing.’ Apps like Uber and Lyft use dynamic pricing when they see a surge of customers in the area that need a ride, such as bad weather, big events, etc.

Dynamic pricing pros

With dynamic pricing, you can decrease prices to increase sales if sales fall below a specific volume. Or, you can raise prices to generate more profit when you see a sales spike. Dynamic pricing can be combined with competitor-based pricing to keep your prices competitive if your competition changes their prices.

Dynamic pricing cons

Dynamic pricing can drastically reduce your conversions if prices are always changing. If your customers know prices are going to fall eventually, they’re more likely to wait it out before making a purchase. In some cases, too many price fluctuations can make customers wary of purchasing from your ecommerce business at all and cause them to lose trust.

Plus, it’s very time-consuming to constantly be changing your prices, especially if you have a higher SKU count.

To get started, there are several dynamic pricing solutions and A/B testing tools like Profasee for Amazon and Intelligems for your own store.

7. Premium pricing

The price of a product conveys its value. Premium pricing is a strategy used to price valuable luxury or high-cost items. With premium pricing, the goal is to communicate that your products or brand is renowned and/or signifies status. One of the biggest examples of this is designer clothing and accessories.

Premium pricing pros

Premium pricing can be a profitable strategy because you’re only targeting individuals who can afford to purchase your products. With improved targeting, you have lower ad costs as you aren’t targeting the general market.

Premium pricing also means your products are more likely to be worn by celebrities or famous people. You can use this to gain celebrity endorsements or run marketing campaigns with stars to increase brand awareness and aim to be a luxury business.

Premium pricing cons

Premium pricing limits the number of potential customers you can target. If your brand messaging and ad campaigns target the wrong audience, you can end up with a lot of ‘window shopper’ visitors that don’t convert into paying customers.

Shoppers who pay for a premium-priced product will also expect more from your brand, such as a premium shipping. Without a strong brand reputation, positive customer reviews, and evidence of products being of high quality, you’ll have a hard time making a sale.

8. Anchor pricing

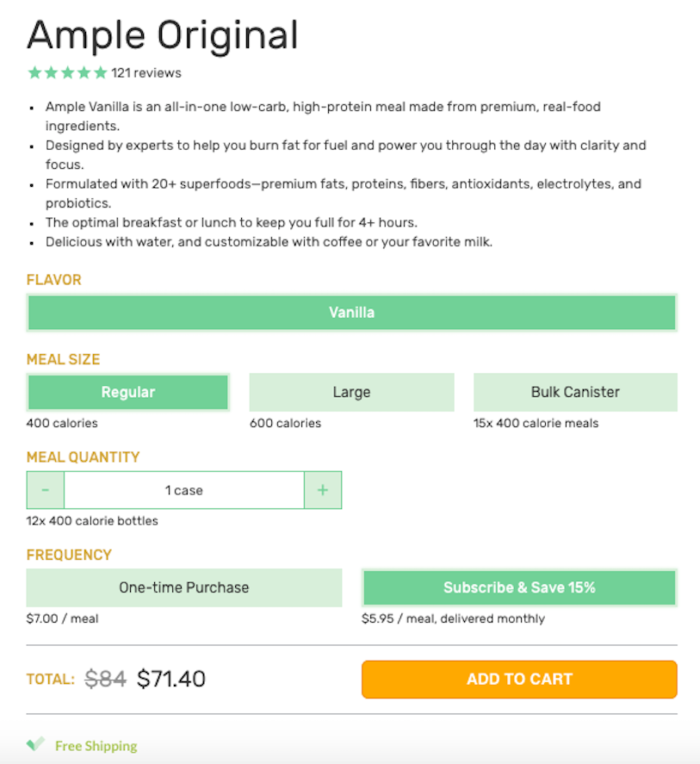

Anchor pricing is a strategy that gives customers a reference price point (the anchor) when researching products. For example, when running a discount offer for a product, your site can display the original price next to the discounted price. For example, an ecommerce store can list a product as ‘$100 $75′ to show the customer how much money they’re saving, even if the product regularly sells for $75 on their store.

Anchor pricing pros

Anchor pricing attracts customers looking for a discount or a deal. It also can spark a sense of urgency. By referencing the higher anchor price point, customers will feel the need to make the purchase right away or miss out on a deal.

Anchor pricing is often used for bundles or subscription orders by showcasing the cost savings a customer gets when they but more or subscribe, rather than making a one-off purchase. In these cases, a discount is offered for committing to multiple items or orders and the customer can test the savings at checkout to verify they would save money this way.

Anchor pricing cons

Anchor pricing can be taken to an extreme, and cause you to lose out on sales. If the disparity between the anchor and the new price point is too large, it could signal that the product has defects or it’s lost its value.

Combining ecommerce pricing strategies when needed

It’s possible to combine ecommerce pricing strategies if it works best for your business. As mentioned earlier, dynamic pricing combined with competitor-based pricing can help you stay competitive.

Combining loss-leader pricing with price skimming can increase your customer LTV in the long run as they’ll continue to purchase multiple products from you as they decrease in price.

Value-cost and competitive-based pricing can be combined to justify why your products have higher prices. You can show that your products have unique features, better materials, resistance to damage, etc. to communicate to customers that your products are worth the extra cost.

By using a combination of ecommerce pricing strategies, you can further improve profits and sales. It may require testing and trial and error, but optimizations can be made.

Pairing efficient fulfilment with optimised pricing

Most ecommerce businesses view order fulfilment as a cost centre, and that they have no choice but to raise prices if they outsource. Or, they understand offering two-day shipping can lower cart abandonment rates and increase average order volume, but it’s not cost-effective.

Ecommerce businesses that partner with a third-party logistics (3PL) company like ShipBob know otherwise. Many of them have found that outsourcing fulfilment to a 3PL is not only cost-effective but has improved their overall logistics strategy.

With ShipBob, ecommerce merchants can offer two-day shipping via ground rather than expensive expedited air shipping to their customers. This way, you don’t have to worry about losing sales to Amazon or other large retailers since customers know they can get packages delivered quickly and affordably.

The right tech-enabled 3PL will help you reduce shipping costs so you can create an ecommerce product pricing strategy accordingly. By working with ShipBob, you can reduce fulfilment costs and make your orders even more profitable.

“Last July, Prymal reached $40,000 in revenue. After switching to ShipBob just four months later in November, we are reaching $160,000 a month in revenue — that’s 300% growth. We’re also saving $8,000 per month in fulfilment costs.”

Courtney Lee, founder of Prymal

ShipBob has a growing international network of fulfilment centres and allows you to split inventory across multiple locations. With distributed inventory, products are shipped from the fulfilment centre closest to your customers to reduce transit time and shipping costs.

Conclusion

There are a lot of factors to consider when developing an ecommerce pricing strategy. Competition, ever-changing customer expectations, material costs, and shipping all play a role in pricing your products. But ecommerce brands that continue to reevaluate their pricing strategy, as well their ecommerce logistics strategy, will continue to stay competitive and profitable.

To learn how ShipBob can help save money on retail fulfilment while growing your business, click the button below for a quote.