Ecommerce Guide to Shipping Insurance: Couriers & Benefits Explained

Skip the Scroll — Download the PDF

Download this blog as a PDF to revisit it whenever you want. We’ll email you a copy.

Table of Contents

** Minutes

How much does shipping insurance cost?

Is shipping insurance worth it?

Though major shipping couriers are generally reliable, packages still get lost and damaged.

In fact, according to a recent survey of US adults that had received packages in Q1 of 2023, 56% had encountered damaged packaging, experienced misshipments, or had their shipments lost altogether. Another report found that 49 million Americans have had at least one package

No matter which party is at fault, customers still expect ecommerce businesses to cover the cost of damaged or undelivered packages. But instead of covering losses out of pocket, you can get your packages insured. Read on about the costs and overall value of shipping insurance.

What is shipping insurance?

Shipping insurance is a service that most couriers offer that protects shippers against lost, stolen, or damaged packages.

If an insured package does not reach its destination, or if it is damaged when it’s delivered, the shipper can file an insurance claim with the carrier. The carrier will then provide reimbursement to the shipper for the declared value of the items in the package.

There are multiple insurance options available for shippers – but not all are the same. Depending on the insurance provider, your insurance policy may:

- Offer additional coverage, such as the cost of shipping as well as the declared value of your shipment.

- Put a cap on the value of goods they cover, and/or the amount of money they will pay out.

- Require you to prove that the damage to a package occurred during transit.

Why is shipping insurance important?

Shipping insurance isn’t just important for peace of mind – for an ecommerce business, it can actually save your bottom line.

For example, say you run an online pottery shop. A customer orders a $50 vase, which you pack safely in bubble wrap and ship out. Unfortunately, the carrier isn’t careful with the parcel, and when the customer opens the box, the vase is shattered.

Without shipping insurance, your business is in a bind. You could refund your customer, but you’d have to cover the expense yourself out of your profits. Alternatively, you could refuse to refund them and keep the money – but this will probably disgruntle the customer, and even discourage them from shopping with you again.

With shipping insurance, you don’t have to choose. For an extra fee up front, you can make amends with customers and keep your bottom line intact.

Shipping insurance costs by carrier

The cost of shipping insurance rates will vary by provider. While you can purchase shipping insurance from an independent shipping insurance company (such as Shipsurance), most major couriers like DHL, UPS, FedEx, and USPS will offer shipping insurance as a value-added service.

For all couriers, shipping insurance rates depend on the value of the shipped items. The more valuable the items, the more expensive the package is to insure. See how much shipping insurance costs for UPS, FedEx, and USPS here:

USPS Insurance Costs

| Value of contents | USPS Insurance cost |

| Up to $50.00 | $2.75 |

| $50.01 to $100.00 | $3.50 |

| $100.01 to $200.00 | $4.60 |

| $200.01 to $300.00 | $6.05 |

| $300.01 to $400.00 | $7.60 |

| $400.01 to $500.00 | $9.15 |

| $500.01 to $600.00 | $12.25 |

| $600.01 to $5,000.00 (maximum liability is $5,000) | $12.25 plus $1.90 per $100.00 or fraction thereof over $600 in declared value |

FedEx Insurance Costs

| Value of contents | FedEx Insurance cost |

| Up to $100 | $0 |

| $100.01 to $300.00 | $4.20 |

| $300.01+ | $4.20 + $1.40 for every additional $100 of declared value |

UPS Insurance Costs

| Value of contents | UPS Insurance cost |

| Up to $100 | $0 |

| 100.01 to $300.00 | $3.45 |

| $300.01+ | $1.15 per $100 declared |

How to file a shipping insurance claim

Filing a shipping insurance claim will be different depending on which shipping service you use. Here’s how to file a claim with 3 of the most popular ecommerce shipping couriers.

File a shipping insurance claim with USPS

For USPS shipments, either the merchant or the end customer can file an insurance claim as long as they have the original mailing receipt.

First, you’ll need to double-check that you still have time to file the claim. In the case of shipping damage or missing contents, USPS gives you 60 days after the mailing date to file. For lost packages, the filing deadline will vary depending on the USPS service (e.g. Priority Mail®, Priority Mail Express®, Collect on Delivery, etc.) used to ship the order.

Next, you should gather the necessary documentation. USPS requires you to produce:

- Tracking or label number

- Evidence of insurance purchased

- Proof of value

- Proof of damage

With these steps complete, you are ready to file your claim online or by mail.

File a shipping insurance claim with FedEx

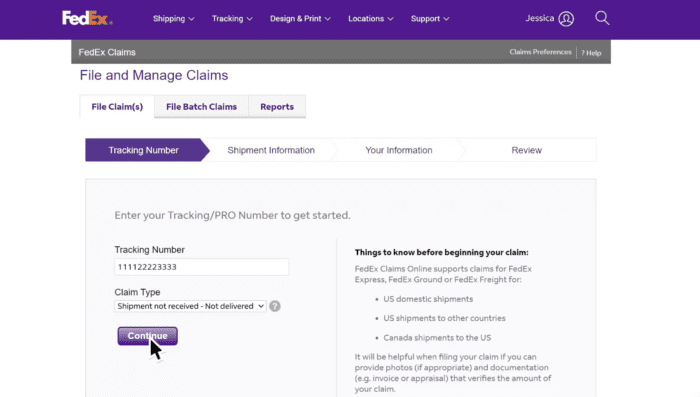

To file a claim with FedEx, start by logging into your online FedEx account. This will auto-populate information from your existing account into your claim to make the process easier. If you choose not to log in, you can still begin filing by entering your order’s tracking/PRO number, selecting the type of claim you wish to make, and completing the online claim form.

From there, you can upload supporting documents and arrange for updates on your claim’s status. While FedEx doesn’t require any specific documentation, it’s always best to provide as much proof of sending, value, and damage as possible. Click here for a full list of suggested documentation.

Once you review your information, you can submit the claim form and track your claim’s status online. FedEx will let you know if your claim requires inspection, so be sure to keep the damaged goods and their packaging until your claim is fully resolved.

File a shipping insurance claim with UPS

UPS allows either the shipper or the receiver to file a claim for lost or damaged packages up to 60 days after the package’s ship date.

To begin, log into your UPS account and enter the package’s tracking number. You’ll then be asked to provide additional details about the shipment, including:

- The package’s weight

- Contact information for the recipient

- Your relationship to the package (shipper, receiver, or third-party)

You must then add documentation to support your claim, such as:

- Receipts

- Invoices

- Purchase orders

- Photos of damaged packages/merchandise

For more information on UPS’ specific documentation requirements, click here.

Once you have details and documentation added, you’re ready to submit your claim. UPS will notify you once your claim is submitted, and let you track claim status through your claims dashboard.

When is shipping insurance worth it?

Whether or not shipping insurance is worth the cost depends on a few different variables. Here are some of the circumstances in which shipping insurance might be the smart choice for your brand.

1. You’re shipping a high volume of orders

The more packages you ship, the higher the likelihood that something will go wrong with at least one of them. So for high-volume shippers like ecommerce businesses, insuring all your packages can help protect you from the inevitable, occasional misshipment or damaged order.

However, you should always keep your margins in mind. If your average order value is low, or your profit per order isn’t big enough to cover the cost of shipping insurance, you’ll need to be selective about which orders you insure (if any).

2. Your products are valuable

In the context of shipping insurance, “valuable” shipments are shipments containing items that have a high monetary value – not necessarily a sentimental or personal value.

Generally, the higher the shipment’s value, the more you stand to lose in the case of theft or mishandling – and thus, the more beneficial it is to have insurance. But ultimately, how much monetary value it makes sense to insure is something you must decide for yourself, and will depend on your budget, profits margins, and overall business strategy.

Below are some examples of low-value items that might not warrant insurance, and some high-value ones that do:

| Low Value (could forgo shipping insurance) | High Value (should get shipping insurance) |

| Phone case | Phone |

| Costume jewelry | Jewlery with precious stones |

| Standard kitchen equipment (bowls, whisks, etc.) | Furniture or antiques |

| A toy instrument | A professional-quality instrument |

| Durable art prints | Hand-crafted painting |

3. You want extra peace of mind

Ecommerce merchants already experience so much uncertainty – so if you are looking for one less thing to worry about, shipping insurance is a great precaution. Extra peace of mind is more than enough reason to add shipping insurance, as the small upfront investment is worth the potential upside if something goes wrong.

How ShipBob delivers ecommerce peace of mind

While the occasional lost or damaged shipment may be unavoidable, choosing the right supply chain partners can go a long way in minimising lost, damaged, or stolen shipments in the first place.

Optimise package size to minimise damage

As a global fulfilment platform, ShipBob partners with thousands of ecommerce brands to simplify and optimise their shipping. When you partner with ShipBob for your fulfilment, we use these best practices to help your brand avoid common shipping mistakes and get the right packages to the right customers at the right time, in the right condition.

When you outsource fulfilment to ShipBob, we’ll pick and pack every order according to your specifications. Using box-selection algorithm technology, our team of experts will automatically select the optimal size box or poly mailer for each order so that the contents fit snugly, minimising jostling and breaking. ShipBob can also include dunnage, bubble wrap, or other cushioning materials in your order to further protect your goods.

File claims for you, for free

If damages occur while your package is in transit, ShipBob will file claims with the carrier on your behalf, at no cost to you. That way, you can focus on guiding customers to the checkout and leave the logistics of refunds to professionals.

Connect you with shipping insurance experts

ShipBob partners with dozens of ecommerce platforms and tools – including ecommerce insurance experts like DSP. DSP works with ecommerce brands to simplify the insurance process and can help your brand find a shipping insurance strategy that’s the right fit.

For more information on how ShipBob can help you ship your ecommerce orders, click the button below.

Shipping Insurance FAQs

Orders lost and damaged in transit with the carrier can have a major impact on your business. Check out some of the most frequently asked questions about shipping insurance.

How much does it cost to ship with insurance?

It depends on the carrier and the value of the shipped items. The costs of shipping insurance from each of the major couriers and postal services are listed above. There are third-party shipping insurers as well that tend to be even cheaper than the major couriers.

How does shipping insurance work?

To get reimbursed when a package is reported missing or damaged, file a claim with your carrier or insurer. You will need to submit documentation proving the value of the items.

The carrier may have to search for a product if it was lost or stolen, which can take up to 10 days. Otherwise, claims processing typically only takes a few days.

Do 3PLs handle shipping insurance?

Some third-party logistics (3PL) providers do while others don’t. Some 3PLs will provide insurance but require the seller to handle claims processing on their own. Here at ShipBob, in every verified case of loss or damage, we can file claims with the couriers on the customer’s behalf and claim up to $100 in retail merchandise value.

As an expert fulfilment provider, ShipBob highly recommends that brands add additional insurance to make sure they can claim the full amount if something goes wrong in transit. You can also purchase extras such as a certificate of mailing for extra peace of mind.

Are there any items or goods exempt from shipping insurance coverage?

Items exempt from shipping insurance coverage will vary from carrier to carrier. Some common items that couriers may decline to cover include extremely valuable products, HAZMAT or dangerous items, perishables or pharmaceuticals, and more.